Cellular app builders are anticipated to push subscriptions extra aggressively over the following 12 months. Numbers that RevenueCat lately shared inspecting over 30,000 apps recommend why: Most apps wrestle to achieve $1,000 per 30 days in income.

RevenueCat makes a subscription toolkit for cell apps. The 7-year-old firm’s study shared at this time, as noticed by TechCrunch, stated the agency examined apps utilizing its in-app subscription SDKs. RevenueCat’s report did not checklist all apps studied however claims Reuters, Buffer, Goodnotes, PhotoRoom, and Notion as clients. The report claims that 90 % of apps with an in-app-subscription platform use RevenueCat. The San Francisco-based firm additionally claims to help “the whole lot from area of interest indie apps to a number of of the highest 100 subscription apps,” which notably means that a lot of the top-100 subscription apps aren’t included on this research.

With these caveats in thoughts, the 120-page report nonetheless gives distinctive particulars a couple of claimed $6.7 billion in subscription income touching over 18,000 builders and 290 million subscribers utilizing the Apple App Retailer and Google Play Retailer.

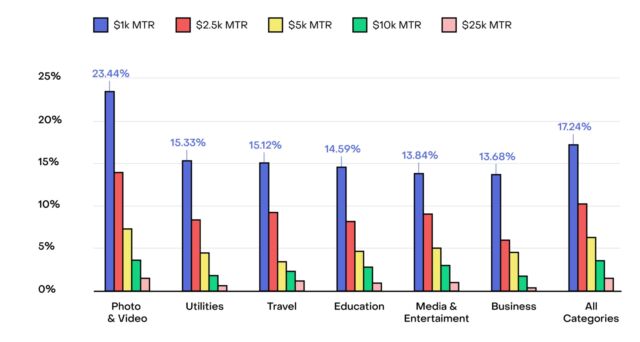

In response to RevenueCat, about 17 % of the apps examined make at the least $1,000 every month. The share of examined apps making extra month-to-month income is even decrease:

RevenueCat famous that when apps do attain $1,000/month in income, they’re extra prone to make $2,500 in month-to-month income (59 % of apps that reached the $1,000 mark reportedly did) and even $5,000/month in income (60 % of the apps that reached $2,500/month in income reportedly did).

Imbalanced income

RevenueCat’s numbers level to a robust imbalance in income share amongst cell subscription apps: The report discovered that 12 months after launching, the highest 5 % of apps make over 200 instances the income of the underside quartile. For brand spanking new apps, the median month-to-month income after one 12 months is “a little bit beneath $50.”

“When segmenting right down to the highest 10 % and even high 5 % of performers, income numbers enhance quickly, going from $223 (higher quartile) to $971 (Q90), to $2,352 (Q95) in month-to-month income,” the report says.

Nonetheless, with promoting spending continuing to tumble and builders on the lookout for a approach to generate recurring income to help app upkeep, help, and developments, subscriptions are anticipated to proceed being builders’ major technique. RevenueCat’s research quoted Ariel Michaeli, co-founder and CEO of cell app developer reporting platform Appfigures, as saying that firm information discovered that 59,000 new subscription-based apps got here out in 2023.

Subscription fatigue

Challenges in cell app subscriptions embrace not solely convincing folks to pay for an app but in addition convincing them to take action repeatedly. RevenueCat stated that in comparison with its 2023 report, the portion of month-to-month subscribers retained after one 12 months declined by 14 %, “impacting each the most effective and worst performers alike.” Different insights embrace month-to-month subscriptions having a median first renewal price of over 60 % however sustaining solely 36 % of the unique batch of subscribers by the point it is time for a 3rd renewal.

Cellular-app builders hoping for recurring {dollars} are interesting to a person base more and more deterred by subscription fatigue. In response to a 2022 report from administration consulting agency Kearney, 42 % of shoppers “assume they’ve too many subscriptions.” However whereas extra industries are specializing in subscriptions, cell apps, some argue, are a use case the place recurring funds make extra sense than in different companies, like printers.

“For the merchandise that sit in a really recurring use case, this is usually a win-win for the shoppers and the enterprise. The longer that somebody needs to make use of the services or products that you simply present, the larger the enterprise you possibly can construct,” Dan Layfield, founding father of Subscription Index, a subscription monetization consulting agency, stated in RevenueCat’s report.

Larger costs

Cellular app subscription charges are anticipated to extend over the following 12 months. The common month-to-month price elevated 14 %, from $7.05 to $8.01, within the 12 months since RevenueCat’s 2023 report. Issues like rising buyer acquisition prices, curiosity in wanting like a premium app, and AI might economically problem mobile-app builders and have an effect on pricing.

However RevenueCat additionally expects that over the following 12 months, devs will experiment extra with different income streams, like in-app purchases and online marketing.